Your goals powered

by the expertise

of Fund of Funds Lp

Fund of Funds Lp is a trusted partner in global fixed income investment, providing deep

insights and a disciplined approach to help clients reach their long-term

financial goals in both public and private markets.

Welcome to Fund of Funds Lp

A Fund of Funds Lp is an investment strategy that pools capital to invest in a diversified portfolio of other investment funds rather than directly in individual securities. This approach allows investors to access a wide array of asset classes, strategies, and management styles with a single investment, thereby enhancing diversification and potentially reducing risk.

Typically, a fund of funds may focus on hedge funds, private equity, venture capital, or mutual funds, depending on its investment objectives. By investing in multiple underlying funds, a Fund of Funds Lp aims to capitalize on the expertise of various fund managers, allowing for a broader exposure to market opportunities and investment strategies.

Investors benefit from professional management, as Fund of Funds Lp often employ experienced analysts to select and monitor the underlying funds. However, it's important to note that this layered structure can result in higher fees, as investors pay not only the fees of the fund of funds itself but also the fees of the underlying funds. Overall, a fund of funds can be an effective way for investors to achieve diversified exposure while leveraging the expertise of seasoned fund managers.

Experience

Proven Expertise and Professionalism

With over a decade of experience, we deliver innovative solutions backed by deep industry knowledge and proven practices. Our team is proud to have helped clients achieve their goals, consistently adapting to changes and staying ahead of the curve.

Our Journey to Success in the Investment World.

2009

Fund Established

Our fund was founded in 2009 with the aim of providing investors with access to a diversified portfolio of funds. From the beginning, our mission was to enhance diversification and manage risks efficiently.

2011

Expanding Investment Portfolio

In 2011, we expanded our investments into hedge funds and private equity, offering clients access to highly profitable asset classes.

2013

Building a Strong Analytical Team

We assembled a team of experienced analysts in 2013 to manage and monitor the underlying funds, ensuring clients' portfolios were optimized and risk was mitigated.

2015

Introducing Venture Capital Investments

In 2015, the fund began investing in venture capital, helping to drive innovation and growth in high-potential startups globally.

2017

$500 Million in Managed Assets

By 2017, our fund had reached a major milestone by managing over $500 million in assets, reflecting the trust and satisfaction of our investors.

2019

Global Expansion

We expanded our reach globally in 2019, opening up new opportunities for our clients by investing in international markets.

2021

Innovative Risk Management

In 2021, we implemented advanced risk management strategies that helped our clients weather market volatility while maintaining portfolio growth.

2024

15 Years of Success

As we celebrate 15 years of successful operations in 2024, we continue to innovate and provide our clients with top-tier investment solutions through a diverse range of funds.

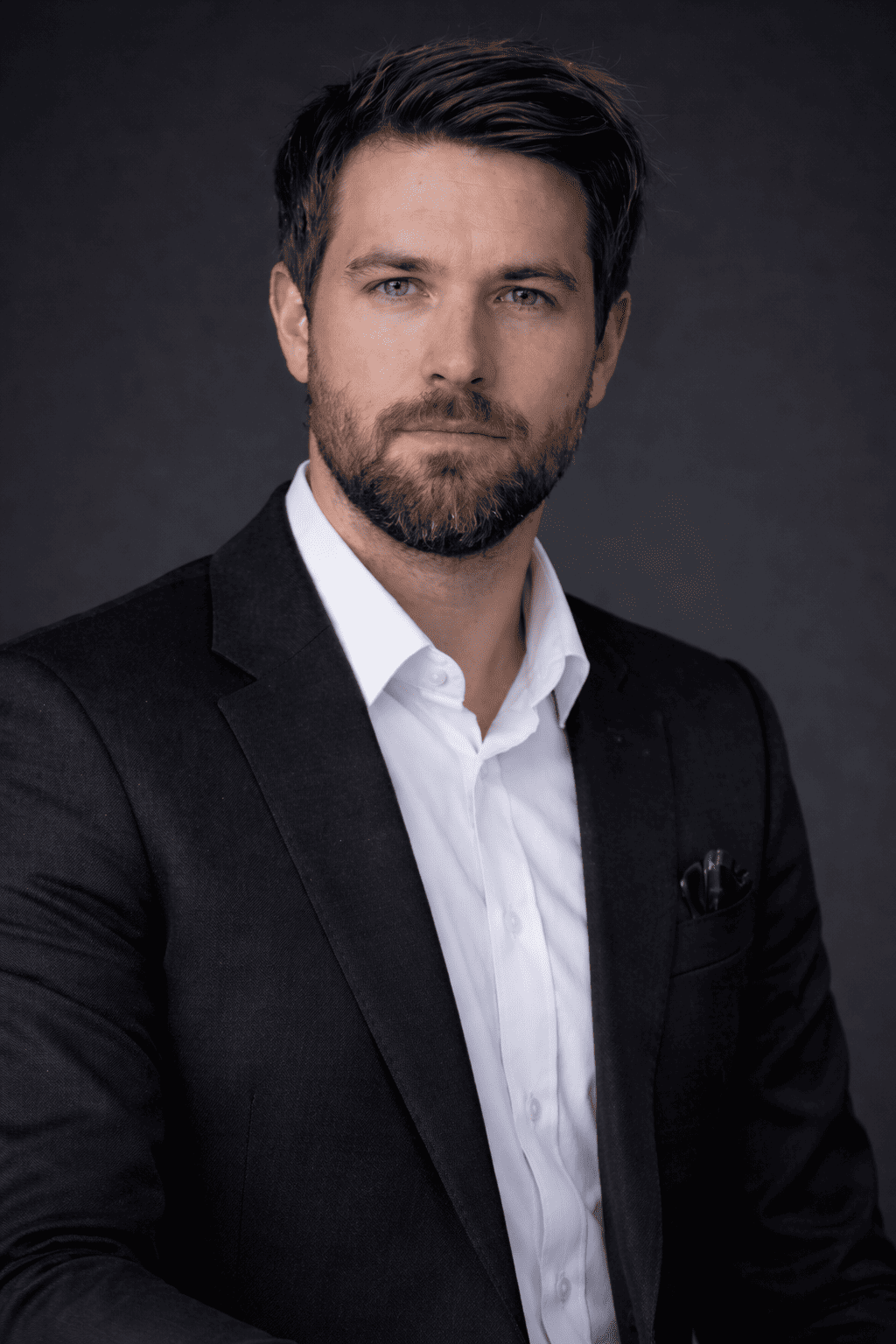

The Leadership Team

The Executive Committee sets the strategic course for the company and supervises the full range of our operations.

Igor Nikolaevich Fisyun

Investment Advisor (IA), Personal Investment Consultant, Relationship Manager (RM)

Aleksandr Mavrits

Brokerage Sales Manager, VIP Client Manager, Personal Account Manager

Sergey Lutov

Client Relationship Manager, Client Manager, Client Acquisition Specialist

Ilya Malkin

Personal Broker, Investment Consultant, Client Broker

Maksim Burdenko

Client Relationship Manager, Client Manager, Client Acquisition Specialist

Igor Brovsky

Brokerage Sales Manager, VIP Client Manager, Personal Account ManagerReady to take the next step and work with us?